Imagine it is your birthday and you receive 2000 cash from your grandparents as a gift. Now from that moment, you start thinking about how to spend it rather than thinking about saving it or investing.

And this is because young minds are not taught about financial literacy and financial hygiene and they don’t understand the importance of savings, investment.

What is financial hygiene?

Financial hygiene is about introducing a few practices in our day-to-day life to stay financially fit.

Financial hygiene is essential for survival. Most people are unaware that basic financial practices are the key to a secure future. Your savings will help you in times of crisis. Hence, it is important to understand that no income is disposable, all your money is hard-earned, and you should take good care of it.

Financing is a broader term and it doesn’t only restrict itself to earning, spending or saving but also filing tax returns, understanding the basics of credit cards, mortgages and checking accounts, and preparing for one’s retirement.

But unfortunately, all these basic skills are not taught during the formative years of one’s education.

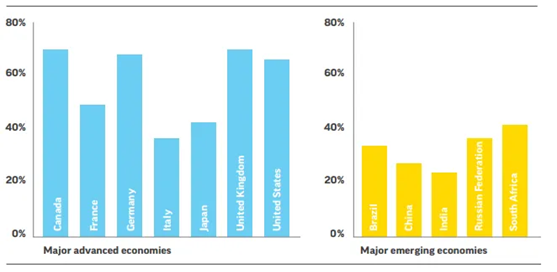

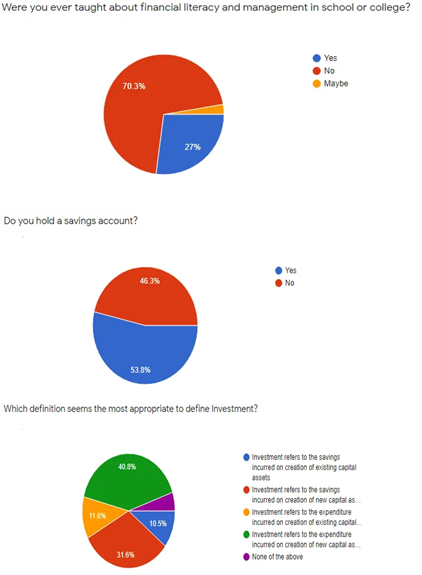

Out of the 1.3 billion, only 24% of the Indian adult population is financially literate. It is also the lowest when compared with other emerging economies. A survey was conducted to analyze the financial knowledge of the population aged between 16–50 years (urban population). Out of approximately 100 responses, data is as follows:

Through the survey, it is found that 76.3% of the respondents were never taught financial education or management in schools and colleges. The majority of the respondents were 16–40 years old and yet only 53.8% had a savings account. 59.2% of the respondents picked the wrong definition of Investment. Therefore, these responses reaffirmed the need for financial literacy in India.

Here are a few ways to maintain and teach financial hygiene to teens:

BUDGET PLANNING: The best way to learn how to do something is through hands-on experience. Parents can try giving small amounts of money to them ask them to pay bills such as newspaper bills, electricity bills, water bills or ask to bring groceries. this way they will know how to plan their budget.

FINANCIAL LITERACY: Children should be made aware of interests, taxes, terminologies related to finances, basics of financing. I also strongly believe financial literacy should be included in the senior secondary curriculum.

AWARENESS: Nowadays everything is digitalized so it is important they’re made aware of the online scams and also know how to protect their financial data online.

POCKET MONEY: By giving pocket money they will not only know budget planning but also learn to save.

Very useful tips about financial hygiene is provided . Very useful

Very useful information

Learnt something new today through this blog, a lot of useful information

This article examines the significance of financial literacy and discusses the difficulties young adults encounter when managing their finances.

The blog emphasizes building a sustainable, healthy financial life over quick fixes, encouraging readers to take a holistic approach to their finances.

Comments are closed.